- November 10, 2017

Honoring our student veterans by closing the 90/10 loophole

This Veterans Day weekend, as we honor those who have sacrificed so much in service to our country, we remember our continual obligations to our veterans. We owe it to our veterans to ensure they have access to high-quality health care, a place to call home and the skills they need to have a successful life as a civilian.

We also owe our veterans the opportunity to obtain a world-class education that will lead to a fulfilling career and a productive life. After serving in the U.S. Navy for five years in a hot war in Southeast Asia, I returned home to a GI Bill that provided me $250 per month, enabling me to earn my MBA at the University of Delaware. Today, veterans have access to the Post-9/11 GI Bill, the most generous GI Bill in the history of our country that fully covers tuition, fees, books and housing at many of our nation’s colleges and universities, like the University of Delaware and Delaware State University, for veterans and their families.

The Post-9/11 GI Bill affords veterans the invaluable opportunity to attain a high-quality education here at home after their service, and they deserve nothing less. Since 2009, more than 1.7 million service members, veterans and their families have financed their higher education using the Post-9/11 GI Bill. However, over the past seven years, 40 percent of Post-9/11 GI Bill tuition benefits have gone to for-profit colleges, even as questions are raised about these institutions’ graduation, default and job placement rates. Today, many of the top recipients of Post-9/11 GI Bill funds are currently under investigation for deceptive and misleading recruitment practices or other possible violations of state and federal law.

The Post-9/11 GI Bill affords veterans the invaluable opportunity to attain a high-quality education here at home after their service, and they deserve nothing less. Since 2009, more than 1.7 million service members, veterans and their families have financed their higher education using the Post-9/11 GI Bill. However, over the past seven years, 40 percent of Post-9/11 GI Bill tuition benefits have gone to for-profit colleges, even as questions are raised about these institutions’ graduation, default and job placement rates. Today, many of the top recipients of Post-9/11 GI Bill funds are currently under investigation for deceptive and misleading recruitment practices or other possible violations of state and federal law.

The 90-10 Rule is a bipartisan federal law passed by Congress in the 1990s that requires for-profit schools to derive at least 10 percent of their revenues from sources other than the federal government. However, a loophole exists that allows for-profit schools to count military and veteran education assistance as non-federal revenue. As a result, some for-profit institutions have aggressively—and sometimes deceptively—recruited veterans and their GI Bill benefits to receive 100 percent of their revenues from taxpayers.

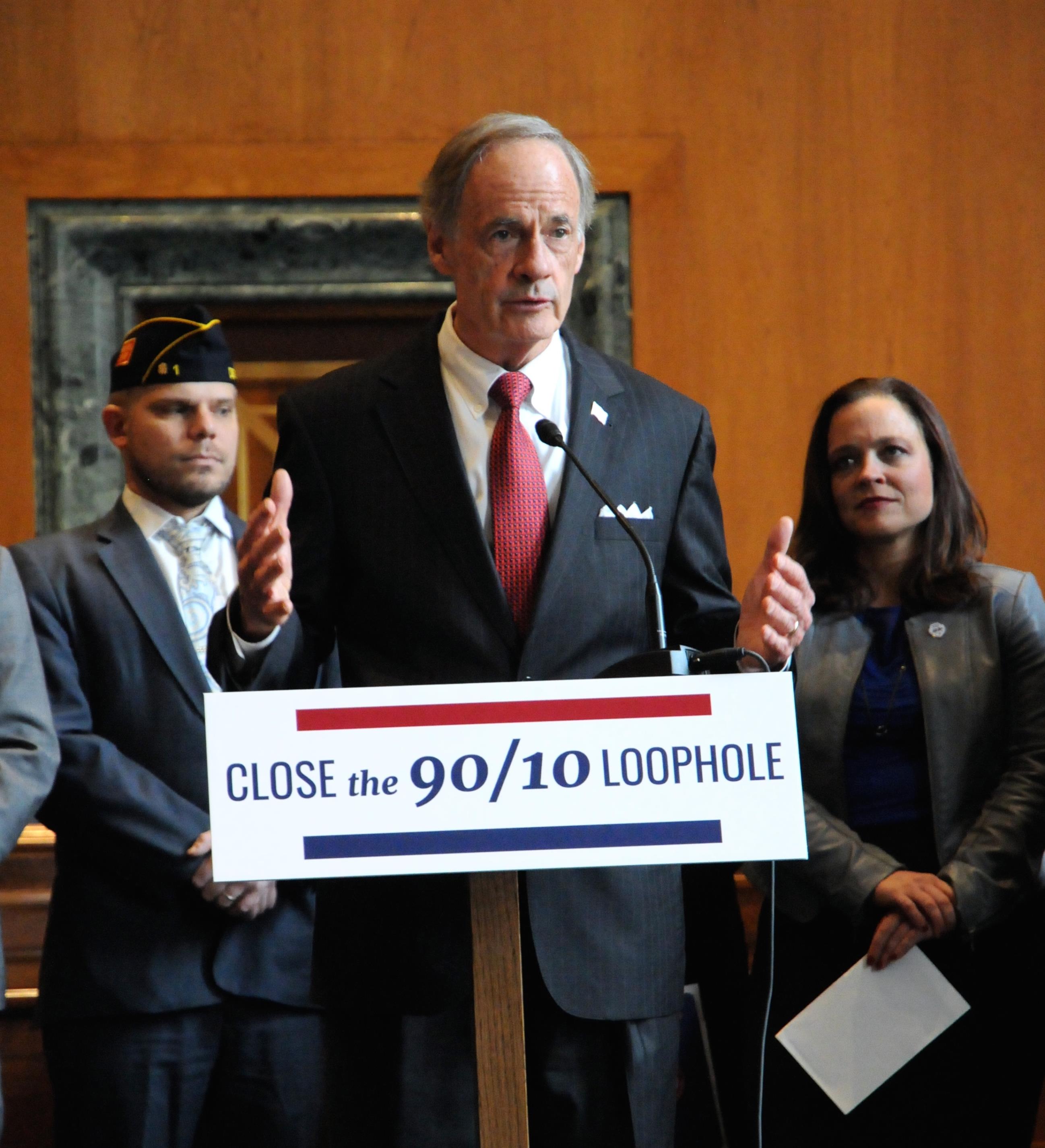

That’s why, yesterday, I joined with Senators Patty Murray (D-Washington), Richard Blumenthal (D-Connecticut), Dick Durbin (D-Illinois) and representatives from Student Veterans of America, The American Legion, Vietnam Veterans of America, Tragedy Assistance Program for Survivors, Military Order of the Purple Heart and Veterans Education Success to reintroduce the Military and Veterans Education Protection Act. This bill would close the 90/10 loophole, protecting student veterans by counting military and veterans’ education dollars as federal dollars, which they are.

That’s why, yesterday, I joined with Senators Patty Murray (D-Washington), Richard Blumenthal (D-Connecticut), Dick Durbin (D-Illinois) and representatives from Student Veterans of America, The American Legion, Vietnam Veterans of America, Tragedy Assistance Program for Survivors, Military Order of the Purple Heart and Veterans Education Success to reintroduce the Military and Veterans Education Protection Act. This bill would close the 90/10 loophole, protecting student veterans by counting military and veterans’ education dollars as federal dollars, which they are.

While not all for-profit schools are bad actors, one veteran misled or mistreated by a for-profit school is one veteran too many. Our commitment to care for our veterans is a sacred obligation. On behalf of our veterans, I’m urging my colleagues in Congress to come together and close the 90/10 loophole.